Written by the Mackenzie Fixed Income Team

Key Highlights

- US Treasuries have historically strengthened during volatile periods, offering reliable safety for investors when needed most. Despite concerns, the US has the tools and political will to support its bond market

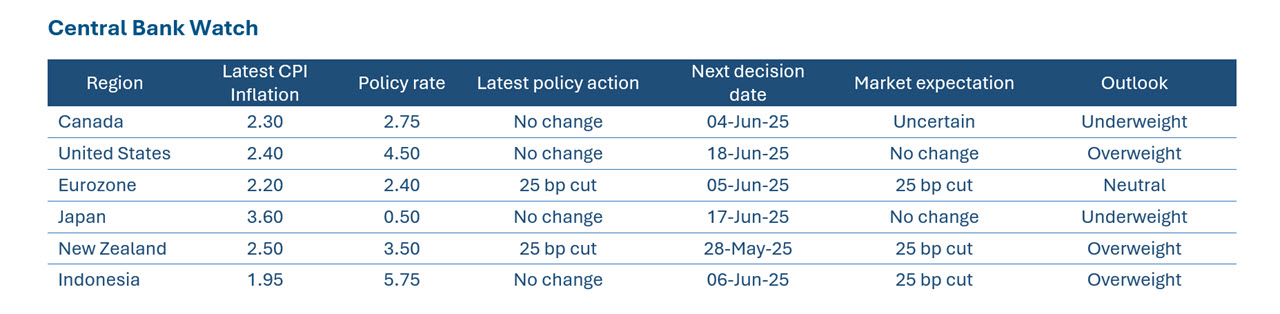

- The Bank of Canada has decided to keep interest rates steady, awaiting global policy decisions to guide future actions, reflecting uncertainty in the economic outlook.

- We remain overweight portfolio duration in US Treasuries and reducing credit risk by focusing on higher-rated credits. Exposure is maintained in New Zealand and Indonesian government bonds, with new investments in Brazil, Mexico, and Colombia due to favorable currency conditions.

- Exposure to tariff-sensitive sectors has been reduced, with a shift towards defensive sectors like pipelines, telecoms, utilities, and senior bank debt. The tactical credit risk allocation, enabled our credit portfolios to capitalize wider spreads mid-month and selectively increase risk at attractive valuations for enhanced returns.

Fixed Income Market Update

US Treasuries have historically demonstrated antifragility, meaning that during periods of heightened volatility, they have not weakened but strengthened. This rare characteristic in financial markets has provided investors with reliable safety precisely when it is most needed.

There is growing debate about whether the Federal Reserve might be forced to act like an emerging market central bank, prioritizing inflation credibility or capital flight risks over domestic growth. Despite recent market anxieties, such a shift remains highly unlikely. The US has both the necessary tools and political incentives to defend the integrity of its bond market. The support could flow in part from one or combination of the Fed, US Treasury department, Political leadership. Ultimately, in a world where credibility and liquidity are non-negotiable, policymakers will act decisively, not because they want to, but because the alternative is fundamentally unacceptable. Periods of doubt and volatility are inevitable, but the structural incentives and capabilities to preserve the Treasury market remain overwhelmingly compelling.

For the first time in nearly a year, the Bank of Canada has decided to keep interest rates steady. Heading into the meeting, market expectations were split on whether there would be a rate cut, but the Bank chose to pause, aligning with the slight majority view. This decision wasn't made because the future is clear, but rather because it is anything but. Essentially, the Bank isn't waiting for more data; it's waiting for a global policy decision that will shape the economic narrative for the rest of the year.

Fund Positioning

In the current fixed income landscape, our strategy is centered on a deliberate extension of portfolio duration in nominal US treasuries, reflecting a nuanced regional allocation. Simultaneously, we are prioritizing a reduction in sector specific risk with greater focus toward increasing exposure to higher-rated credits.

We continue to hold our exposure in New Zealand and the rate cut in April supports that view as the central bank views the heightened tariff related volatility to dampen growth and cheaper oil prices to push inflation lower. In the EM space we continue to hold exposure to Indonesian government bonds as the central bank held rates in its April meeting motivated by the need to bolster the currency depreciation. We expect rate cut in its upcoming policy amid faltering growth concerns and managing currency volatility through FX intervention. We have also initiated exposure towards Brazil, Mexico & Columbia as we see these country currencies to benefit from a weaker dollar and rotation of flows into EM assets. Brazil central bank has cumulative tightened 425 bps since Sept’24 raising the Selic rate to 14.75%. We expect reduced pace of rate hikes & lower expected inflation to support the bond prices.

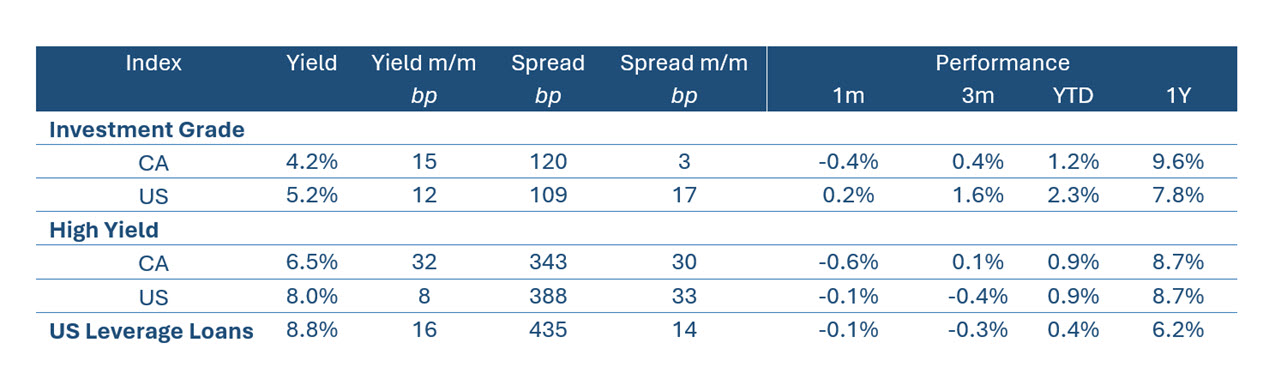

To mitigate risks from trade policy uncertainties, we proactively reduced exposure to tariff-sensitive sectors. This strategic move enabled our credit portfolios to capitalize on wider spreads, which exceeded their long-term averages mid-month. By selectively increasing risk at these attractive valuations, we positioned the portfolios to capture enhanced returns. This has added resilience across mandates with overweight corporate exposures amid higher rates volatility. The economic backdrop remains weak, and we have actively de-risked by trimming exposures in Canadian energy, retail, such as consumer discretionary, industrials, and automotive, and even our long-held subordinated bank debt. Our credit remains concentrated in more defensive sectors: pipelines, telecoms, utilities, and core senior bank debt. In the US, we pre-emptively lowered exposure to sectors heavily tied to government spending, including healthcare, pharma, and technology. These adjustments aim to insulate the portfolio from volatility tied to geopolitical developments. Meanwhile, we maintain a neutral position in leveraged loans, reflecting a cautious yet balanced approach to this segment of the market.

Credit Market Performance

April was a tale of two halves for investors with Trump’s liberation day announcement sparking recession fears only to be followed by a de-escalation phase of the global trade war. The credit space was jolted by early announcement of sweeping tariffs on goods from a range of countries, triggering the sharp spike in volatility. As a result, the new issue market virtually shut down during the month. The prices recovered in the final week of the month to largely end flat led by de-escalation in the trade policies. We continue to witness dispersion in the credit space with the HY index providing a +1.0% gain ytd, with BBs (+1.8%) outperforming Single Bs (+0.8%) and CCCs (-1.0%). Sector dispersion was elevated with Telecom (+3.3%) and Food/Bev. (+2.9%) and lagging within Consumer Products (-1.77%) and Energy (-1.60%).

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of April 30, 2025, including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of April 30, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

All information is historical and not indicative of future results. Current performance may be lower or higher than the quoted past performance, which cannot guarantee results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Performance may not reflect any expense limitation or subsidies currently in effect. Short-term trading fees may apply.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.